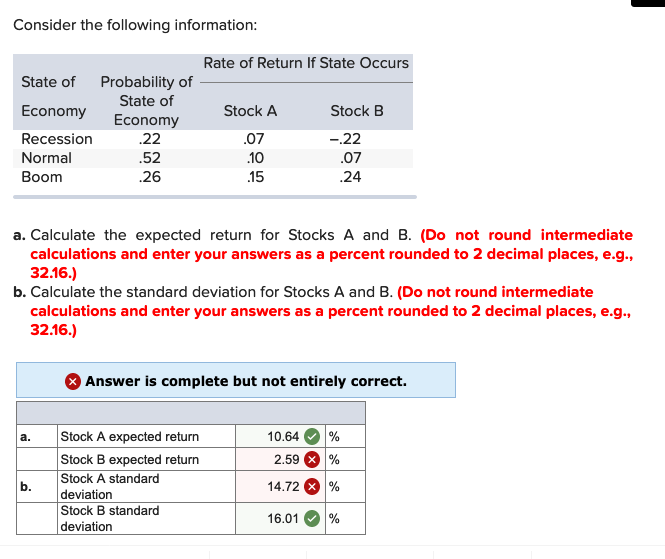

Solved a. Calculate the expected return for Stocks A and B.

Schwab Equity Ratings Schwab Equity Ratings use a scale of A, B, C, D, and F, and are assigned to approximately 3,000 U.S.-traded stocks. Schwab Equity Ratings use a scale of A, B, C, D, and F, and are assigned to approximately 3,000 U.S.-traded stocks.

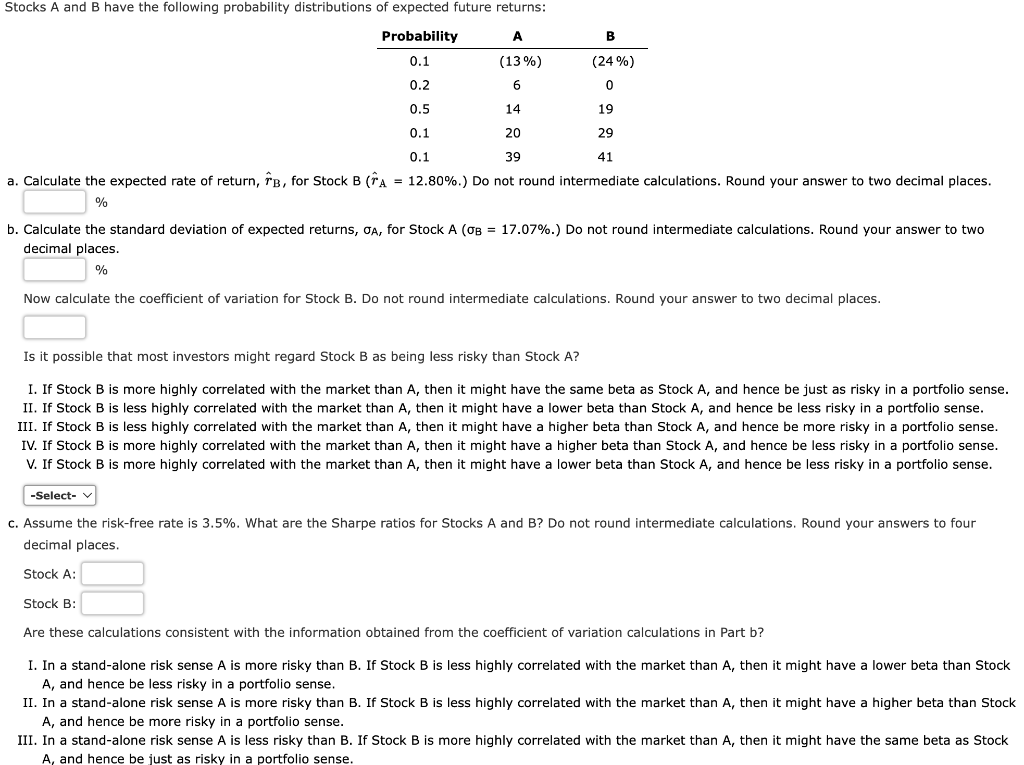

Solved Stocks A and B have the following probability

Class A shares refer to a classification of common stock that was traditionally accompanied by more voting rights than Class B shares. Traditional Class A shares are not sold to the public.

:max_bytes(150000):strip_icc()/dotdash_Final_Make_Money_With_the_Fibonacci_ABC_PatternJan_2020-5d08cd44eaea4ae192e08c1f68758b8f.jpg)

Make Money With the Fibonacci ABC Pattern

Ditto for the B, C, D and F grades. The stocks that's the highest A may look very different than a stocks that is the lowest A (almost a B). Stock selection (even within all the A-rated stocks), how tight you place your stops, when and how you enter the trade will all affect your results.

(Get Answer) A small market consists of three stocks, A, B, and C. and their... Transtutors

Corporate charters - not the law or the courts - define the difference between the classes of stock, often designated as Class A, B and C. Understanding how various classes of stock.

/the-difference-between-stocks-and-bonds-417069-final-5bbd17bd46e0fb00268fdc8c.png)

What Are the Differences Between Stocks and Bonds?

Fortunately, the back-end load declines gradually while you hold the fund, and eventually the load goes all the way down to zero. However, one drawback of B share funds is that they usually have something called a "12b-1 fee," which increases the expenses of the fund. 12b-1 fees are paid out of mutual fund or ETF assets to cover the costs of distribution (marketing and selling mutual fund.

[Solved] Problem 10 Statistics for three stocks A, B, and C, are shown in the following tables

If the company must liquidate its assets, Class B shareholders have priority over Class A shareholders. Class C shares may be Executive Stock, which is given to the top management of the company as part of their compensation package. Each Class C share has 10 votes. Class C shareholders receive the same access to dividends and assets as Class A.

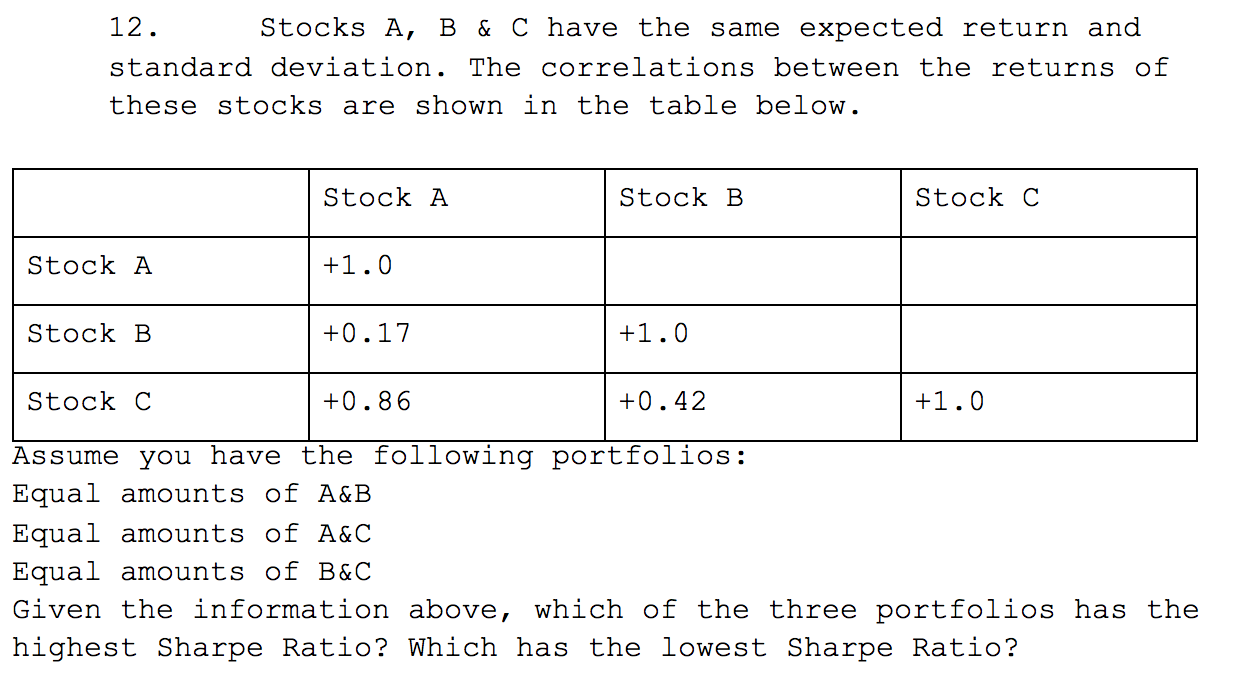

Solved 12. Stocks A, B & C have the same expected return and

A letter, followed by the word 'stock', in the 'retail industry', refers to the degree of 'newness' of an inventory or specific product item. Inventory items can be referred to as A, B, C & D-Stock conditions as well as 'Demo', 'Refurb', 'Close-out', 'Overstock', 'Second', 'Blems', 'Factory Overruns', and more.

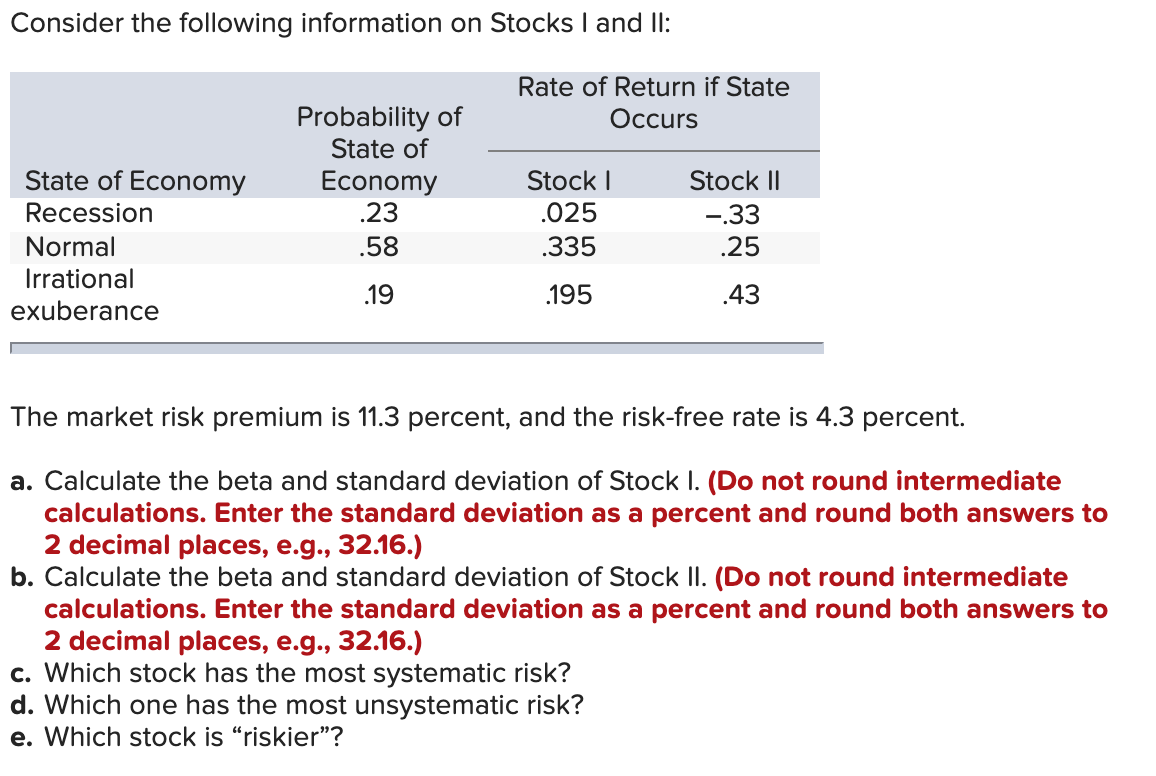

Solved Consider the following information on Stocks I and

Class A Shares vs. Class B Shares: An Overview The difference between Class A shares and Class B shares of a company's stock usually comes down to the number of voting rights assigned to the.

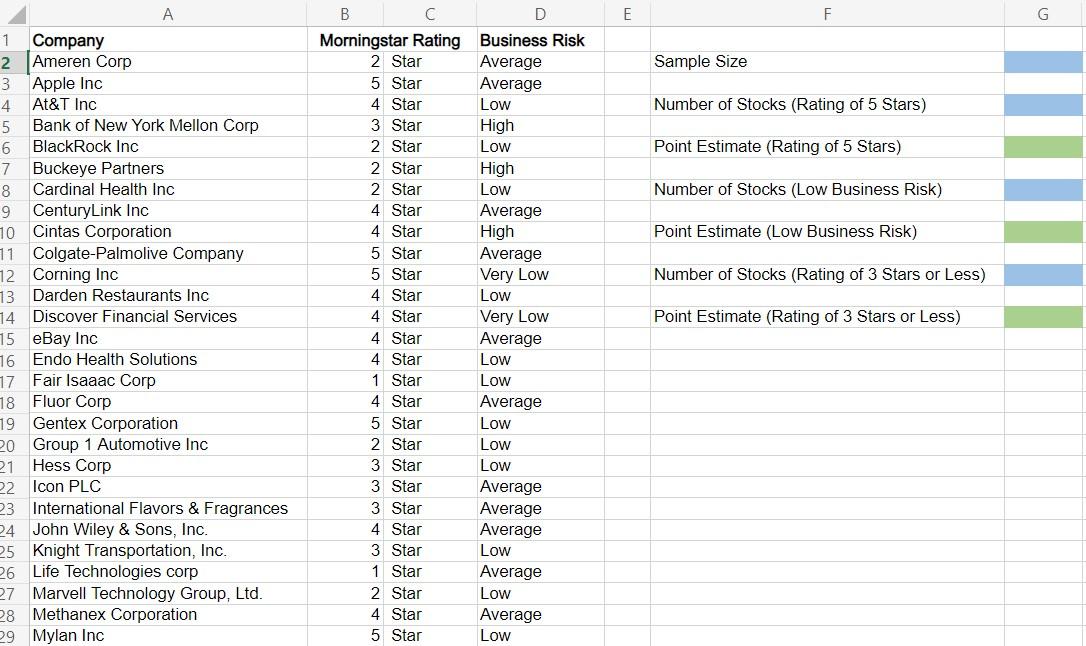

Solved Morningstar publishes information on 1208 company

Tickers GOOG and GOOGL both represent shares of Alphabet common stock, but they are two distinct share classes that have slightly different prices and attributes. Most publicly traded stocks.

Solved Consider the following information for Stocks A, B,

Correlation coefficient shows how much two stock move in relation to each other. The coefficient can have the value in range from -1 to 1. Value of 1 stands for strong positive correlation, where two assets move identically.On the other side, -1 stands for strong negative correlation where two assets move in completely different directions. Value of 0 indicates that two assets are unrelated.

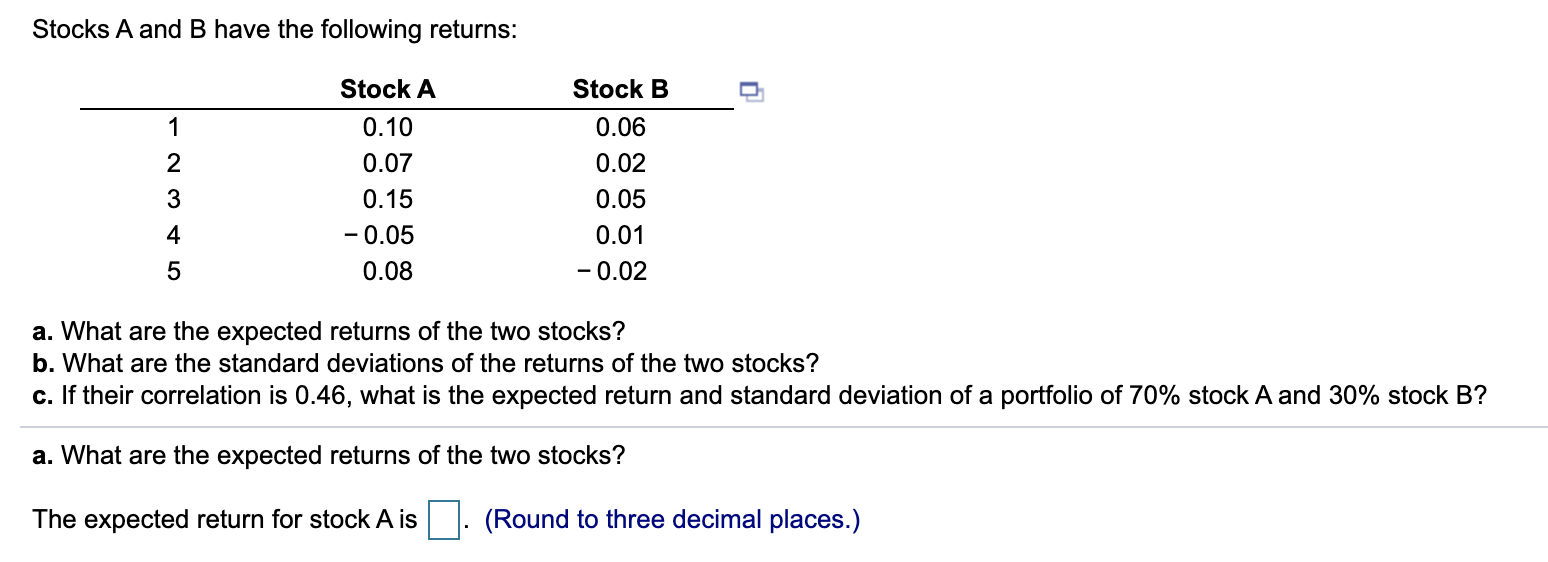

Solved Stocks A and B have the following returns Stock A

A stock market crash is a sudden, steep drop in stock prices that occurs over a short period and may take years to recover. Various factors, such as a financial crisis, geopolitical turmoil, or a sudden change in investor sentiment, can trigger crashes. Some of the most notable stock market crashes in history include: The Black Tuesday crash of.

[Solved] Consider the following probability distribution for stocks A and B... Course Hero

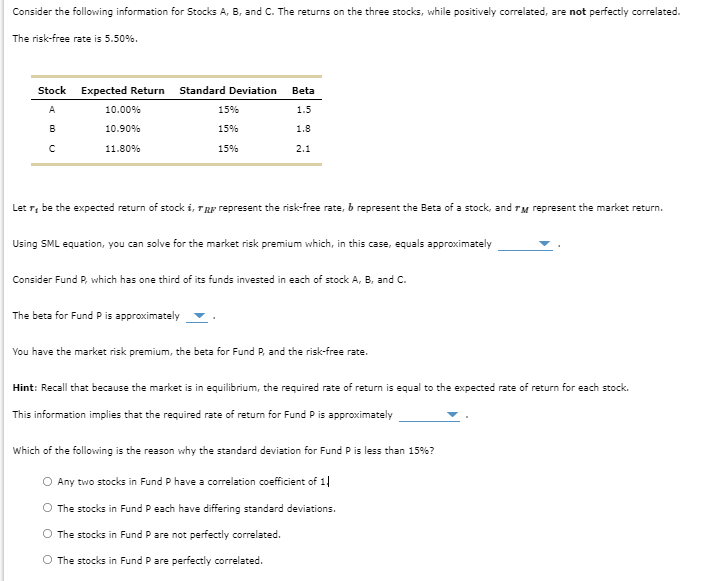

Economics Finance Question Consider the following information for Stocks A, B, and C. The returns on the three stocks are positively correlated, but they are not perfectly correlated. (That is, each of the correlation coefficients is between 0 and 1.)

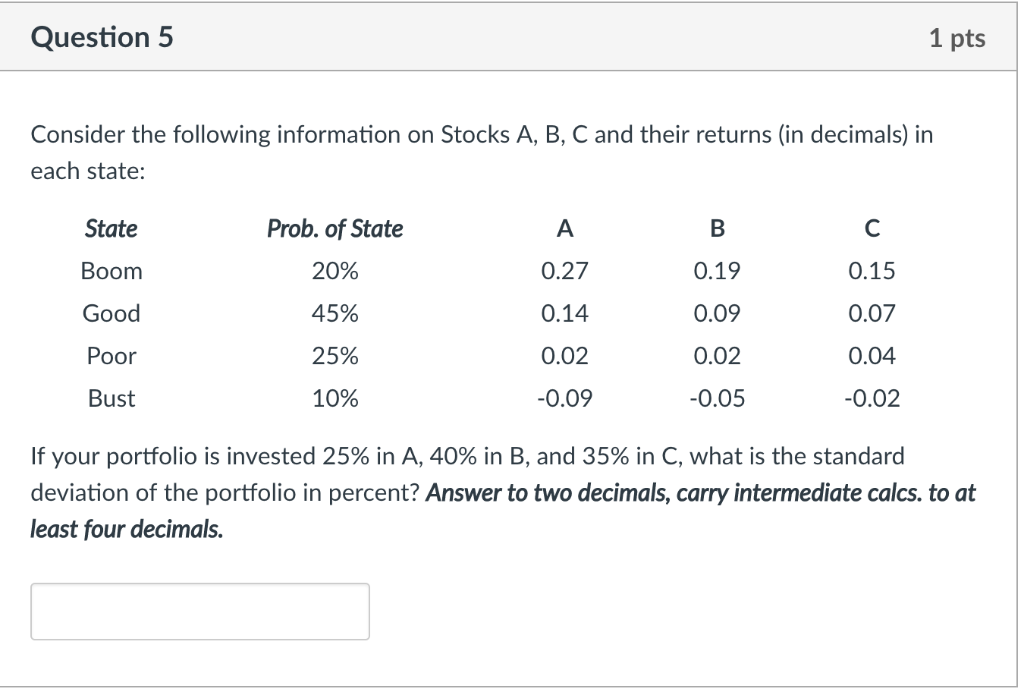

Solved Consider the following information on Stocks A, B, C

A 50-to-1 stock split in 2010 sent the ratio to 1/1,500 th, which means each share of a Class A common stock was convertible at any time to 1,500 shares of Class B common stock.

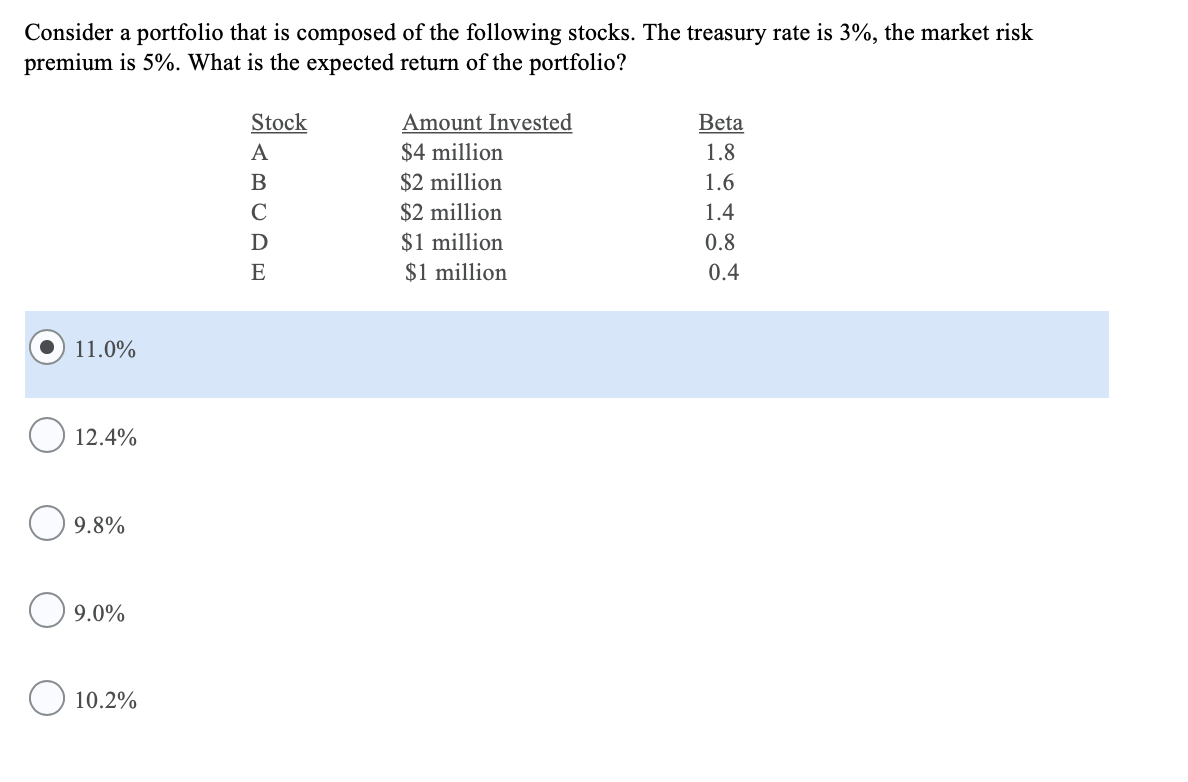

Solved Consider a portfolio that is composed of the

• Class C shares can refer to shares given to employees or alternate share classes available to public investors, with varying restrictions and voting rights. Why Companies Have Different Types of Stock Shares When a company goes public, they are selling portions of their company, known as stocks, to shareholders.

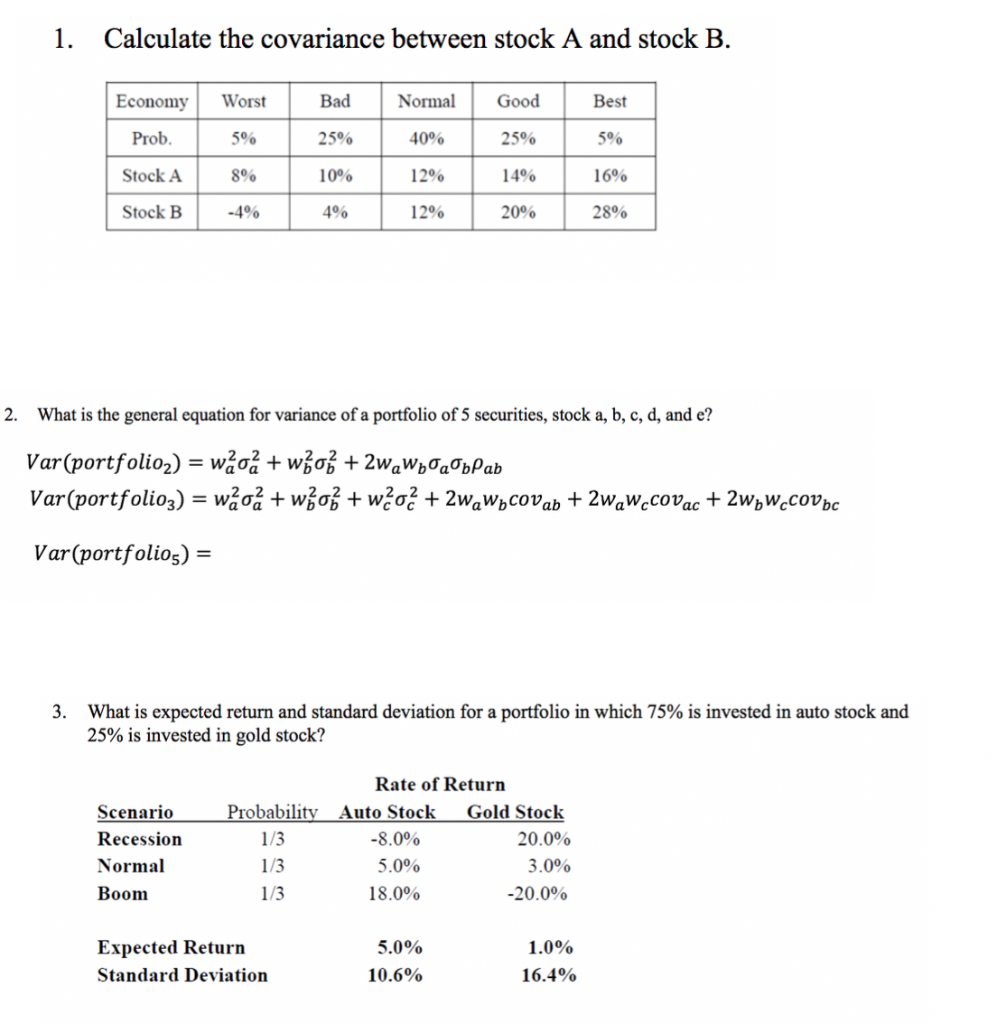

Solved Calculate the covariance between stock A and stock B

When a company issues Class A and Class B shares of stock, it can define these shares almost entirely as it pleases. It can give Class B shares three votes each, or it can say that Class A stock receives half of Class B. So long as the definitions do not violate a shareholder's legal rights, the company can set these terms as it pleases.

SOLVEDStandard Deviation and Beta There are two stocks in the market, Stock A and Stock B. The

The downside is that Class B shares don't have a high control. The voting power and price doesn't necessarily have to be in proportion. For example, Class A shares could cost around $3,000 and receive 100 votes. On the other hand, Class B shares may cost up to $120 with just a single vote.